Digital Currency Growth

In recent years, the financial world has witnessed an unprecedented surge in Digital Currency Growth. This revolution is not just transforming the way we think about money but also how we interact with the broader financial landscape. From the advent of Bitcoin to the proliferation of thousands of altcoins, digital currencies are carving a new path for secure, decentralized, and accessible finance for all. This blog delves into the factors driving this growth and what it means for the future of finance.

The Driving Forces Behind Digital Currency Expansion

Several key factors contribute to the rapid expansion of digital currencies. Firstly, blockchain technology offers unparalleled security and transparency, attracting both individual and institutional investors. Secondly, the global shift towards digitalization, accelerated by the COVID-19 pandemic, has highlighted the convenience and efficiency of digital transactions. Moreover, increasing awareness and understanding of cryptocurrencies is encouraging more people to invest in and use digital currencies in daily transactions.

- Blockchain’s Role: Highlighting how blockchain technology underpins the growth of digital currencies.

- Digitalization Trend: Exploring how global digitalization trends are accelerating digital currency adoption.

The Impact of Digital Currency on the Financial Landscape

Digital currency growth is not just about the increasing value and popularity of cryptocurrencies. It’s fundamentally changing the financial landscape, introducing new forms of investment, payment methods, and financial services. Decentralized finance (DeFi) platforms, for instance, are challenging traditional banking by offering peer-to-peer lending and borrowing services without the need for intermediaries. This shift towards a more inclusive and accessible financial ecosystem is one of the most significant impacts of digital currency growth.

- Decentralized Finance (DeFi): The role of DeFi in democratizing access to financial services.

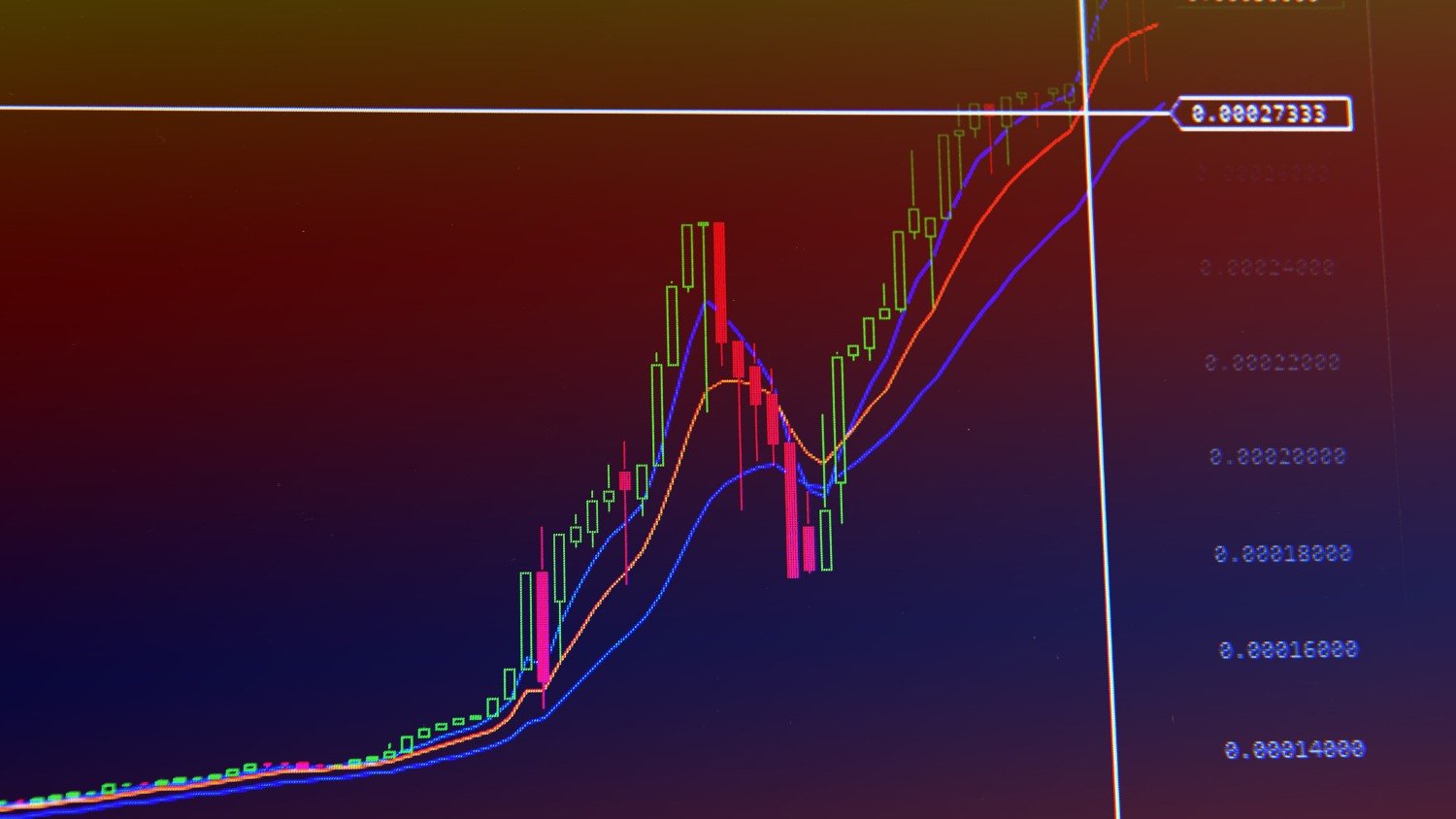

- Changing Investment Patterns: How digital currencies are creating new investment opportunities and diversifying portfolios.

Challenges and Opportunities in Digital Currency Adoption

While the growth of digital currency presents numerous opportunities, it also faces challenges, including regulatory hurdles, market volatility, and security concerns. Addressing these challenges is crucial for the sustained growth and mainstream adoption of digital currencies. However, these challenges also present opportunities for innovation, such as the development of more secure digital wallets and the implementation of regulatory frameworks that protect investors while fostering innovation.

- Navigating Regulatory Landscapes: The importance of developing regulatory frameworks that support digital currency growth.

- Security Enhancements: Innovations in security measures to protect digital assets.

Conclusion

The unstoppable growth of digital currency is set to continue reshaping the financial landscape in the years to come. As we navigate this evolving market, staying informed and adaptable will be key to leveraging the opportunities presented by digital currencies. The future of finance is digital, and it promises a world of secure, efficient, and inclusive financial services accessible to all. Embracing the growth of digital currency is not just embracing a new form of money; it’s embracing the future of the global economy.